Johnson & Johnson on Tuesday announced its plans to acquire Abiomed, which develops technologies for heart, lung and kidney support, in a deal worth more than $16 billion.

WHY IT MATTERS

The purchase will help to advance the standard of care in heart failure and recovery worldwide, according to Johnson & Johnson.

Abiomed will operate as a standalone business within Johnson & Johnson MedTech, becoming one of the company’s dozen “priority platforms,” defined by annual sales of at least $1 billion.

With all forms of cardiovascular disease – the number one cause of death – leading to heart failure and extended hospitalizations, the addition of breakthrough treatments like Abiomed’s positions Johnson & Johnson to drive solutions for one of healthcare’s largest unmet needs.

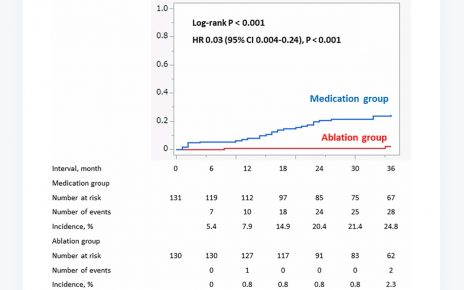

The Danvers, Massachusetts-based company’s Impella heart pumps have received the only U.S. Food and Drug Administration approvals for patients with severe coronary artery disease requiring high-risk percutaneous coronary intervention (stents), treatment of those with acute myocardial infarction (heart attack) in cardiogenic shock or right heart failure.

“Abiomed’s skilled workforce and strong relationships with clinicians, along with its innovative cardiovascular portfolio and robust pipeline, complement our MedTech portfolio, global footprint and robust clinical expertise,” said Ashley McEvoy, executive vice president and worldwide chairman of MedTech at Johnson & Johnson in the announcement.

As a first-to-market provider of cardiovascular medical technology with 18 years of profitable growth, Abiomed offers the world’s largest healthcare products company significant expansion opportunities in one of the fastest-growing medtech segments.

Johnson & Johnson will acquire the company through a tender offer of all outstanding shares for an upfront payment of $380 per share in cash – an enterprise value of approximately $16.6 billion, including cash acquired. Abiomed shareholders will also receive a non-tradeable contingent value right to receive up to $35 per share in cash if certain commercial and clinical milestones are achieved.

“Together, we have the incredible opportunity to bring lifesaving innovations to more patients around the world,” McEvoy said.

THE LARGER TREND

Detecting heart disease earlier and lowering mortality rates inspires many healthcare organizations to research and fund breakthrough technologies.

That’s because heart disease is the number one killer in the world, noted Dr. Waqaas Al-Siddiq, CEO of Biotricity, in a conversation earlier this week about remote cardiac and kidney monitoring.

Chronic disease is also “the No. 1 expense for the healthcare system because patients are diagnosed late and their condition requires them to be in and out of the hospital often,” he said.

From artificial intelligence-driven tools like remote patient monitoring and diagnostic technologies that speed up the identification of atherosclerosis, the leading cause of heart disease, digital health companies must get the scale, cost and quality right in order to stand out in a crowded marketplace.

ON THE RECORD

“This transaction partners us with an organization that shares our patients-first mindset and creates immediate value for our patients, customers, employees and shareholders. It will enable us to leverage Johnson & Johnson’s global scale, commercial strength and clinical expertise to accelerate our mission of making heart recovery the global standard of care,” said Michael R. Minogue, Abiomed’s chairman, president and CEO.

Andrea Fox is senior editor of Healthcare IT News.

Email: [email protected]

Healthcare IT News is a HIMSS publication.

Source: Read Full Article